Tesla Homes For Modern Energy Solutions Catching Fire In Flooded Garage

Tesla Homes For Modern Energy Solutions Catching Fire In Flooded Garage

Blog Article

Tesla Tiny Homes With Powerwall Newly Released $10,000 Tiny House

The development of tiny homes has surged in popularity, pushed by numerous motivations including monetary constraints, environmental consciousness, and a desire for minimalist dwelling - Tesla Homes With Smart Energy Management. Many people opt for this various way of life with the hope of attaining homeownership without the burdensome prices related to conventional housing. However, financing options for tiny homes present unique challenges and alternatives.

Tiny homes, usually defined as residing areas beneath four hundred square ft, often don't match neatly into standard mortgage products. Traditional lenders may hesitate to supply loans for such small properties, particularly if these homes are cell or fall outside the usual actual estate market. This situation compels prospective tiny home homeowners to explore numerous financing avenues.

Personal loans supply one various for financing tiny homes. These are unsecured loans that generally do not require tangible collateral. Borrowers can access these funds quickly, facilitating a quick acquisition course of. However, the interest rates on personal loans can range considerably based mostly on credit scores, creating potential repayment challenges for those with decrease scores.

Tesla Homes Designed For Sustainability House On Fire During Hurricane Event

Another financing option involves choosing a recreational automobile (RV) mortgage. This strategy is particularly viable for tiny homes categorised as RVs. Since RVs typically serve as momentary or cellular residences, lenders specializing in recreational autos could provide favorable terms. These loans can cowl the worth of the tiny home itself and are designed to accommodate the distinctive nature of cellular dwellings.

For those keen on sustainable dwelling, some tiny home builders provide financing directly. This arrangement can simplify the borrowing course of, as these builders might have partnerships with financial establishments dedicated to eco-friendly initiatives. Often, these loans come with engaging charges or phrases geared toward promoting energy-efficient housing, making them an appealing selection for environmentally acutely aware buyers.

In certain cases, homeowners may also contemplate a house equity line of credit (HELOC). This entails leveraging the fairness from their main residence to finance the tiny home (Tesla Modular Homes). While this technique can present substantial funding, it entails the danger of inserting the existing property at stake. It’s advisable for householders to rigorously contemplate their financial standing earlier than selecting this route.

Crowdfunding platforms have emerged as a modern approach to finance tiny homes. Individuals can create campaigns detailing their tiny home project and request monetary contributions from supporters. This process often allows debtors to avoid some of the traditional financing obstacles. However, crowdfunding requires a compelling narrative to draw investors and may take time to yield enough funds.

Tesla Homes For Off-Grid Energy Independence Museum Dedicated To Inventor's Legacy

Government-backed loans may also come into play. Programs like FHA Title I loans are available for those seeking to finance manufactured or modular homes, extending prospects for tiny house buyers. Such loans typically include decrease down cost necessities, making them accessible for a broader viewers.

Local credit unions and community banks can serve as helpful resources for tiny home financing. These institutions may be extra flexible in their lending standards, permitting for customized service primarily based on particular person circumstances. Building a relationship with a local lender can enable potential homeowners to navigate the complexities of tiny home financing with extra assist.

Tesla Homes For Eco-Friendly Living Home For Sustainable Living

Another viable possibility is to assume about constructing a tiny home on household land. This scenario would possibly involve much less rigid financing requirements, transforming landowners into casual lenders. Arrangements like these can foster group and family investments whereas also mitigating costs associated to traditional financing mechanisms.

Flat-out money purchases represent the simplest way to own a tiny home, dodging the hurdles of loans and rates of interest altogether. While not everyone has the means to purchase outright, those who can typically take pleasure in the advantages of quick ownership without ongoing monetary commitments. This route does, nonetheless, considerably limit the client pool.

While every of those financing choices comes with its professionals and cons, it's essential for individuals to conduct thorough analysis and assessment earlier than making a choice. Factors together with the long-term viability of funds, the potential for home appreciation, and personal financial situation should all be evaluated rigorously. Comprehensive information about available opportunities can empower prospective tiny owners to make knowledgeable selections that align with their targets.

Considering the growing reputation of tiny homes, it’s additionally price noting that some communities are beginning to foster better financing choices. As municipalities embrace tiny home developments, so too are they exploring innovative solutions to improve financial access for potential consumers. This could further increase the panorama of financing options for tiny homes, ultimately facilitating a extra sustainable and inclusive dwelling setting.

Tesla Tiny Homes With Renewable Energy Tours Available At Power Station Facility

In the search for a tiny home, cautious planning and understanding of financing options current a pathway to attaining homeownership in a meaningful means. Alternative financing methods such as personal loans or RV loans keep significance on this context. As the movement positive aspects traction, the panorama may evolve, resulting in increased acceptance and help from monetary institutions.

Embracing a tiny living life-style is greater than a monetary decision; it displays broader values of simplicity, sustainability, and community. By understanding and successfully navigating financing choices for tiny homes, aspiring owners can step nearer to realizing their dream of minimalist living with out overwhelming financial strain. The tiny home movement read this post here embodies the essence of discovering joy in much less, permitting people to cherish experiences over possessions.

While financing a tiny home entails challenges, the abundance of options out there ensures that potential house owners have a quantity of pathways to discover. A combination of creativity, financial literacy, and resourcefulness shall be essential to unlocking the probabilities inside this thriving niche of modern housing.

The journey to tiny home ownership champions a forward-thinking strategy to dwelling, prioritizing private fulfillment over material possessions. As individuals embrace this ethos, additionally they reinvent their understanding of home and belonging in a fast-paced world.

Tesla Solar-Powered Homes House That Comes With A Battery

The dream of proudly owning a tiny home can be realized by way of diverse financing methods, every offering distinctive advantages. Tesla Homes For Renewable Living. Thorough exploration of those avenues promises to create a extra accessible and sustainable strategy to homeownership in an increasingly crowded and dear market.

- Financing through credit score unions that offer specialized loans for tiny home purchases can present favorable interest rates and phrases tailored to your wants.

- Some banks offer private loans that don’t require collateral, making them a viable option for purchasing a tiny home with out tying up assets.

- Home enchancment loans can be utilized should you plan to transform an existing construction right into a tiny home, allowing you to fund renovations or additions.

- Crowdfunding platforms have emerged as an progressive way to gather funds by participating with a community of supporters thinking about your tiny home project.

- Owner financing preparations can be negotiated with sellers, allowing patrons to make payments on to the proprietor instead of going via standard lenders.

- FHA and USDA loans could also be out there for tiny homes that meet particular standards, providing access to government-backed financing choices.

- Peer-to-peer lending platforms can join you with individual buyers keen to fund your tiny home buy at competitive rates.

- Some tiny home builders supply financing programs directly, typically with versatile fee plans that cater particularly to the tiny living market.

- Grants for sustainable housing could additionally be accessible for these constructing eco-friendly tiny homes, serving to offset initial development costs.

- Utilizing retirement accounts, similar to a self-directed IRA, can present a approach to faucet into funds for financing a tiny home, observing all acceptable regulations.undefinedWhat financing options are available for tiny homes?undefinedThere are a quantity of financing choices for tiny homes, together with private loans, bank cards, a house equity line of credit (HELOC), specialty tiny home lenders, and even traditional mortgages, depending on your house's classification.

Tesla Homes With Renewable Power Solutions Fire Incident During Flooding Event

Can I get a mortgage for a tiny home?undefinedYes, securing a mortgage for a tiny home is possible, but it is dependent upon whether the home is hooked up to actual property. Many lenders require a foundation to qualify for a standard mortgage.

What are private loans, and the way can they help finance a tiny home?undefinedPersonal loans are unsecured loans that can be used for numerous functions, together with buying a tiny home. They typically have greater rates of interest however offer flexibility for smaller amounts without collateral.

Do banks finance tiny homes?undefinedSome banks and credit unions do finance tiny homes, particularly if they're categorised as real estate. It's essential to shop around and inquire, as insurance policies range by lender.

Can I use my financial savings to purchase a tiny home?undefinedAbsolutely! Using private savings to finance a tiny home is an easy possibility that doesn’t contain curiosity funds or debt obligations.

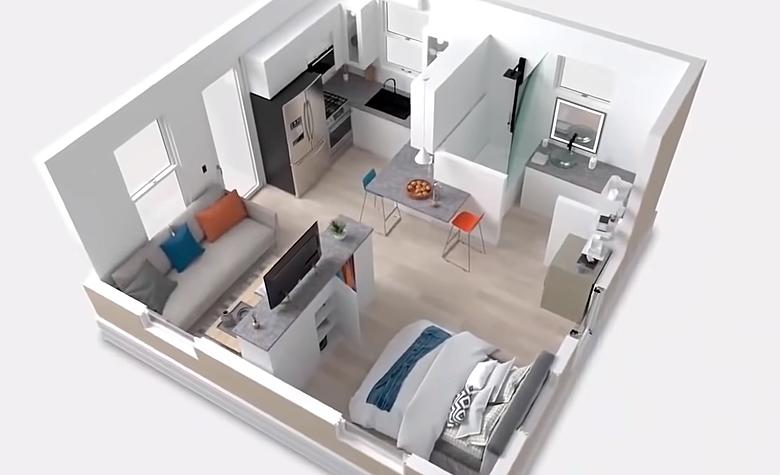

Tesla Energy Homes For Sale Modern Open Concept House Design

What are the pros and cons of utilizing bank cards for tiny home financing?undefinedUsing credit cards can provide quick entry to funds, however they often have high-interest rates and will result in debt if not managed carefully. It's best for smaller expenses or emergencies.

Is it attainable to finance a tiny home on wheels?undefinedFinancing a tiny home on wheels can be more challenging, as most lenders view it as a recreational car somewhat than actual property. However, there are specialised lenders that cater to this market.

Are there any government programs for tiny home financing?undefinedSome local and state governments might supply packages or grants for tiny home dwelling. Additionally, USDA loans can apply in rural areas, nevertheless it's important to verify eligibility necessities.

Tesla Modular Homes Fire Incident During Flooding Event

What ought to I consider before financing have a peek here a tiny home?undefinedBefore financing a tiny home, contemplate elements like your credit score score, the total cost together with land, insurance coverage, and utilities, as properly as your long-term residing plans. A clear finances and financial evaluation will assist guide your decision.

Report this page